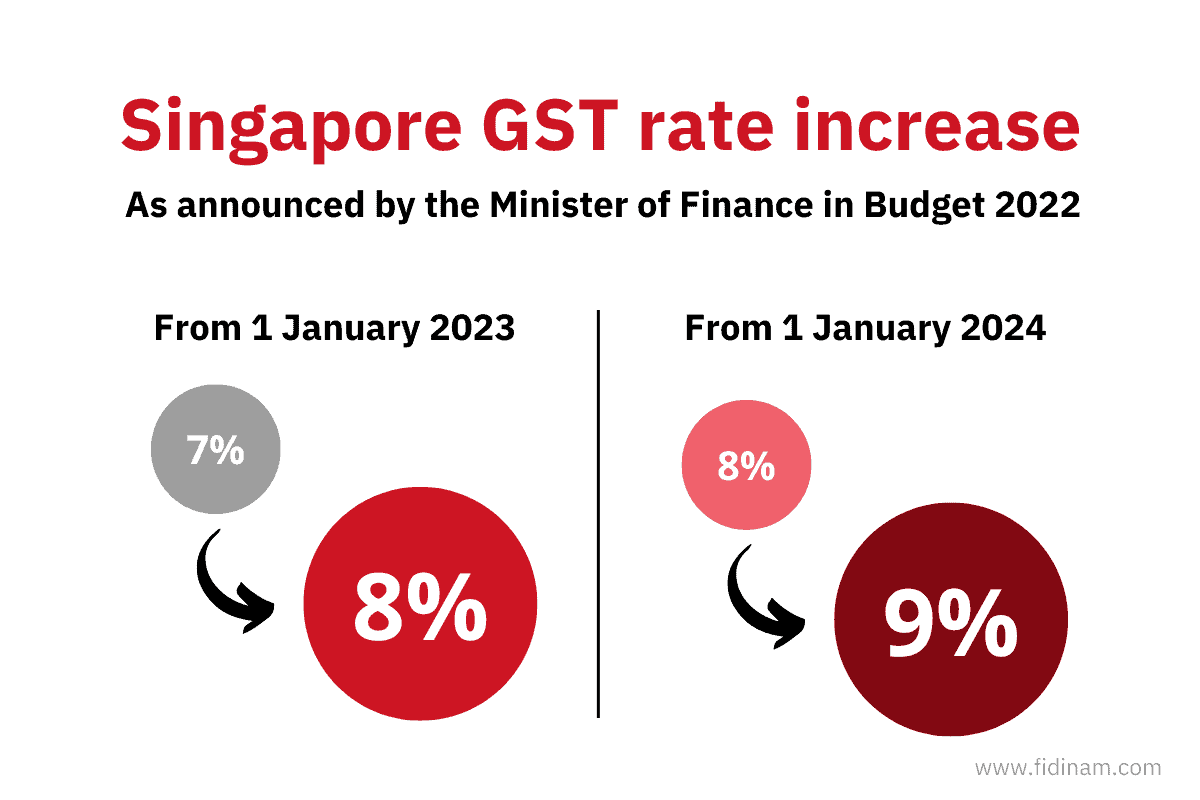

Gst Rate For Construction Contractor . Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web sac code description of services rate (%) cess (%) effective date rate revision; Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Under gst, a works contract is treated as a supply of services. Web the minister for finance announced in budget 2022 that the gst rate increase will be staggered over two steps: Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web what is works contract under gst?

from www.fidinam.com

Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web the minister for finance announced in budget 2022 that the gst rate increase will be staggered over two steps: Web sac code description of services rate (%) cess (%) effective date rate revision; Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web what is works contract under gst? Under gst, a works contract is treated as a supply of services. Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting.

Get your business ready for the GST rate change in Singapore

Gst Rate For Construction Contractor Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web sac code description of services rate (%) cess (%) effective date rate revision; Web the minister for finance announced in budget 2022 that the gst rate increase will be staggered over two steps: Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Under gst, a works contract is treated as a supply of services. Web what is works contract under gst?

From easyaccounting.in

gstratesofconstructionmaterials Gst Rate For Construction Contractor Web what is works contract under gst? Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Under gst, a works contract is treated as a supply of services. Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web 9 rows as per gst, a. Gst Rate For Construction Contractor.

From blog.saginfotech.com

Can One GST Rate Make Product Classification Easier, Check Gst Rate For Construction Contractor Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web the minister for finance announced in budget 2022 that the gst rate increase will be staggered over two steps: Web what is works contract under gst? Web yes, you can claim gst on building construction if you are a construction company, promoter, or.. Gst Rate For Construction Contractor.

From www.billingsoftware.in

GST Cess Guide 2019 Update What is CESS in GST? Gst Rate For Construction Contractor Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web sac code description of services rate (%) cess (%) effective date rate revision; Under gst, a works contract is treated as a supply of services. Web. Gst Rate For Construction Contractor.

From endlessearn.blogspot.com

Long list of GST rates for services Gst Rate For Construction Contractor Web the minister for finance announced in budget 2022 that the gst rate increase will be staggered over two steps: Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web sac code description of services rate (%) cess (%) effective date rate revision; Web what is works contract under gst? Web 9. Gst Rate For Construction Contractor.

From endlessearn.blogspot.com

Long list of GST rates for services Gst Rate For Construction Contractor Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web sac code description of services rate (%) cess (%) effective date rate revision; Web what is works contract under gst? Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web the minister for finance announced. Gst Rate For Construction Contractor.

From instafiling.com

Composition Scheme GST rates Rules, Benefits, Limit (2023) Gst Rate For Construction Contractor Web the minister for finance announced in budget 2022 that the gst rate increase will be staggered over two steps: Under gst, a works contract is treated as a supply of services. Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web yes, you can claim gst on building construction if you. Gst Rate For Construction Contractor.

From www.youtube.com

multiple gst rate entry in tally prime purchase entry with multiple Gst Rate For Construction Contractor Web what is works contract under gst? Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web sac code description of services rate (%) cess (%) effective date rate revision; Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web the minister for finance. Gst Rate For Construction Contractor.

From instafiling.com

GST on UnderConstruction Property (2023 Rates) India's Leading Gst Rate For Construction Contractor Under gst, a works contract is treated as a supply of services. Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web sac code description of services rate (%) cess (%) effective date rate revision; Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or.. Gst Rate For Construction Contractor.

From www.propmania.in

GST rate for construction and building materials Real Estate Blog Gst Rate For Construction Contractor Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web sac code description of services rate (%) cess (%) effective date rate revision; Under gst, a works contract is treated as a supply of services. Web. Gst Rate For Construction Contractor.

From www.cnbctv18.com

Why the new GST rates could deal a body blow to builders Gst Rate For Construction Contractor Web sac code description of services rate (%) cess (%) effective date rate revision; Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web article compiles gst rate on works contract services w.e.f 1st january 2022. Gst Rate For Construction Contractor.

From housing.com

GST rate on construction materials in 2023 Gst Rate For Construction Contractor Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Under gst, a works contract is treated as a supply of services. Web yes, you can claim gst on building construction if you are a construction company,. Gst Rate For Construction Contractor.

From instafiling.com

New GST Rates in India 2023 (Item Wise and HSN Code) Gst Rate For Construction Contractor Under gst, a works contract is treated as a supply of services. Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web what is works contract under gst? Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web sac code description of services rate (%). Gst Rate For Construction Contractor.

From tfipost.com

GST Rates How is the new rate structure going to impact you? Gst Rate For Construction Contractor Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web sac code description of services rate (%) cess (%). Gst Rate For Construction Contractor.

From blog.saginfotech.com

GST Council May Slash GST Rates in Construction Sector to 18 SAG Gst Rate For Construction Contractor Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web the minister for finance announced in budget 2022 that the gst rate increase will be staggered over two steps: Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web 9 rows as per gst,. Gst Rate For Construction Contractor.

From www.rmpsco.com

GST Rate on services provided by subsubcontractors to the main Gst Rate For Construction Contractor Web the minister for finance announced in budget 2022 that the gst rate increase will be staggered over two steps: Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Under gst, a works contract is. Gst Rate For Construction Contractor.

From gstsafar.com

Works contract hsn code and gst rateGST on government works contracts Gst Rate For Construction Contractor Under gst, a works contract is treated as a supply of services. Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter,. Gst Rate For Construction Contractor.

From instafiling.com

GST Rates on Services List) India's Leading Compliance Gst Rate For Construction Contractor Web the minister for finance announced in budget 2022 that the gst rate increase will be staggered over two steps: Web 9 rows as per gst, a contract for the construction, fabrication, completion, erection, installation, fitting. Under gst, a works contract is treated as a supply of services. Web yes, you can claim gst on building construction if you are. Gst Rate For Construction Contractor.

From taxmantra.com

IMPACT OF GST ON CONTRACTORS AND REAL STATE Advisory, Tax and Gst Rate For Construction Contractor Web article compiles gst rate on works contract services w.e.f 1st january 2022 mentioning chapter, section or. Web yes, you can claim gst on building construction if you are a construction company, promoter, or. Web the minister for finance announced in budget 2022 that the gst rate increase will be staggered over two steps: Web 9 rows as per gst,. Gst Rate For Construction Contractor.